Moneyport PSS – the Moneyport Payment and Settlement System – bridges the UK and GCC, providing cross-border financial market infrastructure for efficient and secure transactions

UK-GCCPSS – the UK-GCC Payment and Settlement System – is a cross-border financial market infrastructure facilitating seamless payment transactions between the UK and the GCC. Please note that our service is currently in the testing phase and is not live yet Driving UK-GCC Economic Collaboration Through Seamless Payment

Driving UK-GCC Economic Collaboration Through Seamless Payment

Moneyport PSS ensures instant or near-instant transfers of funds between the UK and the GCC, with transactions settled in mere seconds.

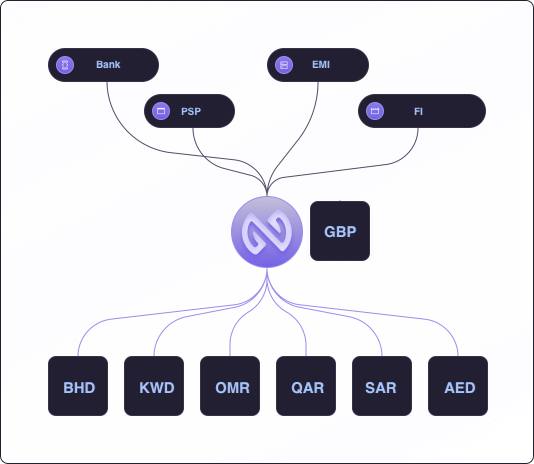

Moneyport PSS is creating a currency corridor that brings significant liquidity advantages and simplifies the historically complex process of cross-border settlements.

Participants in PvP arrangements typically rely on chains of linked correspondent banks to transmit payments.

Moneyport PSS connects commercial banks, payment service providers,

and financial intermediaries, unlocking economic benefits by simplifying

the payment landscape between the UK and the GCC, enabling more

efficient trade across these regions.

Built for rapid global payments and 24/7 financial markets

Today’s cross-border money movement remains slow and constrained. We understand that instant settlement between jurisdictions empowers financial institutions to drive their growth while unlocking new avenues for global economic progress and inclusion.

By facilitating real-time, cross-border fund transfers between financial institutions, Moneyport PSS seamlessly integrates key market players across the UK and GCC into a unified global network, fostering effortless interoperability across borders and currencies.

By facilitating real-time, cross-border fund transfers, Moneyport PSS links major financial players across the UK and GCC, forming a unified settlement ecosystem that ensures seamless interoperability among diverse currencies and markets. This approach replaces the outdated, costly reliance on pre-funded commercial bank accounts, paving the way for a more scalable, efficient global payment infrastructure.

The next generation of cross-border settlement is based on point-to-point atomic processing, eliminating correspondent banking dependencies, while enhancing settlement speed, certainty, and predictability. Our platform leverages ISO20022 standards, using both XML and JSON-based APIs, integrated with advanced cloud technologies to transform global payments.

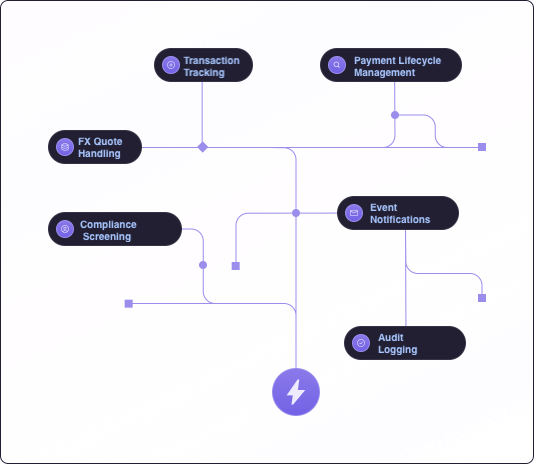

Moneyport PSS is a secure, real-time settlement platform that connects financial institutions and participants in the UK and GCC. It enables seamless, risk-free settlement of transactions through an API-first model built on Oracle Cloud. Our platform facilitates cross-border payments, currency conversions, and real-time settlement services, ensuring compliance with industry standards such as ISO 20022 and FIX.

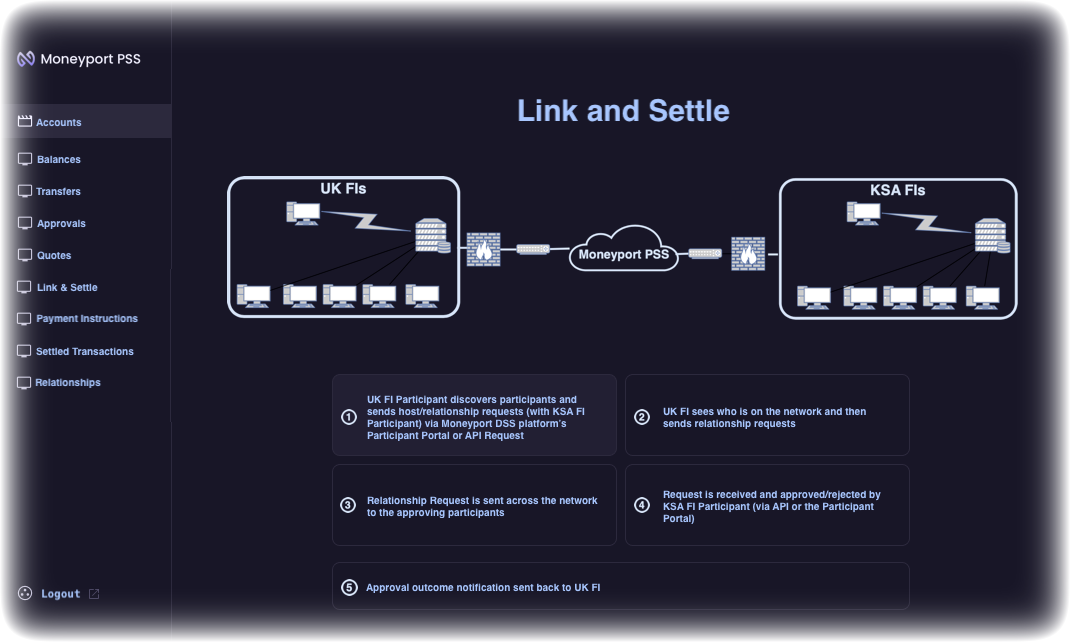

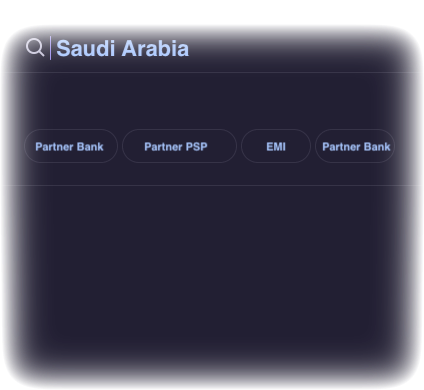

To become a participant, the discovery process must be completed, allowing businesses to find and establish relationships with other participants. Once a relationship is formed, network accounts can be opened in the required currencies. This process is supported by the Participant Discovery and Relationship Management service.

Network accounts can be funded and defunded through the settlement accounts. This ensures that all settlement activities are secure and efficiently managed. These activities can be monitored in real time using the Account Funding and Defunding feature.

FX quotes can be provided by sending and receiving real-time price information for FX trades with other participants. This is facilitated by the Foreign Exchange Quotes service, enabling OTC trade agreements and real-time messaging for seamless settlements.

The PvP Link and Settle service allows two participants to instantly settle an agreed trade, ensuring that payment obligations are met simultaneously. This risk-free settlement ensures instant finality for the trade.

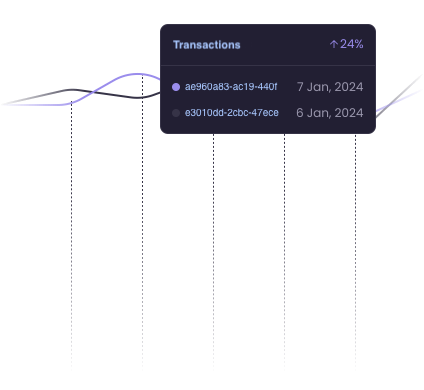

Moneyport PSS provides real-time balance and transaction reports for all network accounts. These reports offer full visibility into account status and transaction history, ensuring transparency and ease of tracking.

Discover how to connect to Moneyport PSS as a Participant by clicking below

Talk to Us